My series of posts on tithing is obviously for readers who are people of faith who care about these things. Feel free to skip this post and other similar ones if you don’t care about the subject.

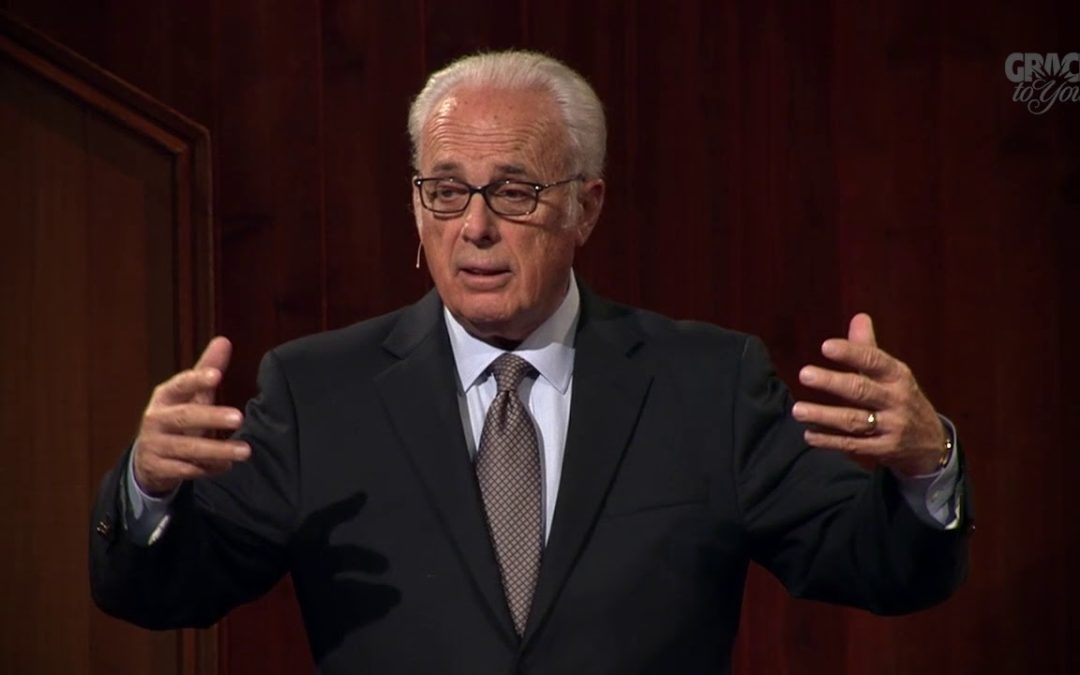

Dr. John MacArthur is one of the most brilliant Christian minds, perhaps of all time. He has written tons of books and commentaries on the Bible and is the founder of The Master’s University (masters.edu).

MacArthur says that in the Old Testament, you had a theocracy, not a democracy. It was a theocracy ruled by God. The priests and the Levites that served at the temple was a tithe tax that was levied to fund the national government in this theocracy. There were several tithes, not just want. One was instituted to fund the temple and priests who worked there, another to support the poor, and another to support the national celebrations. MacArthur says that in total, the tithes (taxes) amounted to a yearly tax of about 23.3%. Every Jew was required to pay that. In addition to that, there was the fixed temple tax and other generous etiquettes such as not harvesting the corners of your field but leaving it for the poor.

He says all of this amounted to about 24-25% annual taxation for each citizen of the kingdom to support the national government. This never was free-will giving. It was taxation.

In Malachi 3, when God says, would you rob me? He is talking about not paying these taxes or tithes. MacArthur goes on to say that in the Old Testament, free-will offering was always a free-will offering. E.g. when the temple was built, people were asked to bring whatever they wanted.

The following appears on John MacArthur’s Website: Does God require me to give a tithe of all I earn? (gty.org)

”

Does God require me to give a tithe of all I earn?

Two kinds of giving are taught consistently throughout Scripture: giving to the government (always compulsory), and giving to God (always voluntary).

The issue has been greatly confused, however, by some who misunderstand the nature of the Old Testament tithes. Tithes were not primarily gifts to God, but taxes for funding the national budget in Israel.

Because Israel was a theocracy, the Levitical priests acted as the civil government. So the Levite’s tithe (Leviticus 27:30-33) was a precursor to today’s income tax, as was a second annual tithe required by God to fund a national festival (Deuteronomy 14:22-29). Smaller taxes were also imposed on the people by the law (Leviticus 19:9-10; Exodus 23:10-11). So the total giving required of the Israelites was not 10 percent, but well over 20 percent. All that money was used to operate the nation.

All giving apart from that required to run the government was purely voluntary (cf. Exodus 25:2; 1 Chronicles 29:9). Each person gave whatever was in his heart to give; no percentage or amount was specified.

New Testament believers are never commanded to tithe. Matthew 22:15-22 and Romans 13:1-7 tell us about the only required giving in the church age, which is the paying of taxes to the government. Interestingly enough, we in America presently pay between 20 and 30 percent of our income to the government–a figure very similar to the requirement under the theocracy of Israel.

The guideline for our giving to God and His work is found in 2 Corinthians 9:6-7: “Now this I say, he who sows sparingly shall also reap sparingly; and he who sows bountifully shall also reap bountifully. Let each one do just as he has purposed in his heart; not grudgingly or under compulsion; for God loves a cheerful giver.”